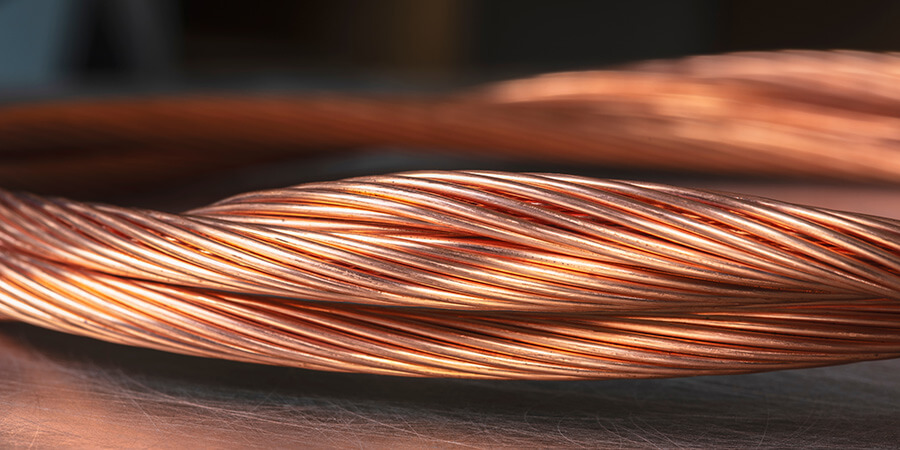

For decades, copper wiring has served as the foundation of global telecommunications, connecting people and countries across vast distances. However, as technology advances, infrastructure upgrades are essential to support next-generation services.

Driven by the need for faster and more reliable connectivity, this transition presents both opportunities and challenges that could significantly impact Canada’s telecom landscape.

Over the next 15 years, the telecommunications industry is expected to generate USD 10 billion in profit from recycled copper, with Canadian telecom operators playing a key role in this endeavor.

As Canadian telecom operators navigate the transition from legacy copper networks to modern fiber optic infrastructure, the value of recycled copper is becoming increasingly apparent.

Copper’s Long Legacy of Connecting the World

Copper’s strategic significance extends beyond mere connectivity. It is a critical component in electric vehicle manufacturing and clean-energy infrastructures. Copper’s electrical and thermal conductive abilities also make it highly valuable for building data centers.

With the demand for electric vehicles increasing globally, copper’s value continues to skyrocket. Recycling copper from telecom networks supports Canada’s broader sustainability goals and electrification strategy. By repurposing copper, telecom companies contribute significantly to renewable energy initiatives, laying the groundwork for a more sustainable future.

Canada’s transition from legacy copper networks to fiber optic infrastructure is fueled by the growing demand for faster, more reliable connectivity services that copper networks can no longer provide. This shift is critical to support next-generation services, such as 5G and cloud computing, which require lower latency and higher bandwidth.

However, this transition presents both opportunities and challenges. The decommissioning of copper networks offers a lucrative opportunity for Canadian telecom operators, while copper’s rising value has led to increased theft.

Canadian Telecom Operators’ Copper Dilemma

The rising value of copper has triggered a surge in thefts, targeting the Canadian telecom industry and posing serious challenges for both operators and customers. The Canadian Telecommunications Association warns that service interruptions may become a public safety concern if customers cannot access 911 emergency calls.

Since 2022, Bell Canada has reported over 1,650 security incidents, with 88% related to copper theft. The problem has intensified, with Bell experiencing a 78% increase in copper theft cases between 2023 and 2024. These thefts have caused significant disruptions across the country. For instance, copper thefts nearly tripled from 40 cases in 2022 to 119 in 2024 in Hamilton, while a USD 30,000 repair at Miramichi Airport was issued for copper worth only USD 100 for thieves. In Ontario and New Brunswick, thieves are becoming increasingly sophisticated, often posing as workers wearing high-visibility gear to remove copper undetected.

In 2024, approximately 15,000 Rogers Communications customers lost connectivity service due to fiber cuts during an attempted copper theft in North Calgary. These incidents highlight the growing problem, with the CTA reporting a 200% annual increase in copper wire theft incidents from 2021 to 2023.

Recently, a thief on a snowmobile was arrested after stealing 200-meter-long copper wire from poles in Gracefield, Quebec. After Bell technicians noticed the missing cable and damage to four Hydro-Quebec poles, a report was made which led to the arrest. The incident has caused 124 Bell customers to lose connectivity for over two days. Moreover, two residents in Ontario’s Lanark Country were charged with a series of copper wire thefts.

Telecom operators have been pushing for stricter penalties under Canada’s Criminal Code to address copper theft crimes. However, legislative changes have yet to materialize, leaving the Canadian telecom industry to grapple with the intensifying threat to Canada’s infrastructure.

Telecom Operators’ Move on the Remaining Copper Networks

As the Canadian telecommunications industry undergoes a significant transformation, telecom operators are leading the charge in shifting from legacy copper networks to modern fiber optic infrastructure. Interestingly, this transition presents a significant financial opportunity for operators, generating revenue while contributing to sustainability goals.

TELUS is at the forefront of this shift, expecting to generate USD 500 million from selling decommissioned copper over the next five years. Through its ‘green copper urban mining initiative,’ TELUS has already removed over 4,000 tons of copper, nearly doubling its ‘other income’ category between 2023 and 2024. This initiative aligns with TELUS’ broader sustainability efforts as the company migrates customers to its PureFiber network.

With approximately 637,000 kilometers of copper wiring, Bell Canada is also repurposing old copper. However, the company takes a more cautious approach to profitability from recycling due to ongoing theft challenges, a key concern for the company’s copper networks in Ontario and New Brunswick.

Meanwhile, Rogers Communications does not anticipate major revenue from decommissioned copper. Like other Canadian telecom operators, Rogers faces vandalism and theft targeting its remaining copper infrastructure.

Globally, telecom operators are adopting similar strategies, with the United Kingdom’s BT earning £105 million (USD 133 million) from recycling old copper cables as part of its transition to fiber optics. Recently, AT&T announced the start of its copper retirement process at 25% of its wire centers.

These initiatives highlight the potential for telecom companies to fund infrastructure upgrades while contributing to environmental sustainability.

Despite copper’s promising opportunities, Canadian telecom operators face challenges in addressing theft. Under Canada’s Criminal Code, copper theft is penalized as ‘theft under USD 5,000,’ with telecom operators arguing that the penalty does not reflect the crime’s significant impact.

Final Thoughts

Telecom operators will play a pivotal role in shaping the future of Canada’s telecommunications. The coper-to-fiber transition represents both a technological leap and a strategic opportunity for telecom operators.

However, challenges remain. Combating copper theft will require coordinated collaboration between telecom providers and policymakers to safeguard Canada’s connectivity landscape.

By repurposing decommissioned copper as a valuable asset rather than waste, Canadian telecom operators are proving that innovation is possible while contributing to global sustainability.